Pc payroll calculator

Simple Payroll Calculator Paycheck Manager Small Business Low-Priced Payroll Service 3 Months Free Trial Starting as Low as 6Month Start Free Trial Simple Paycheck Calculator. For example if an employee earns 1500 per week the individuals annual.

Payroll Calculator Download

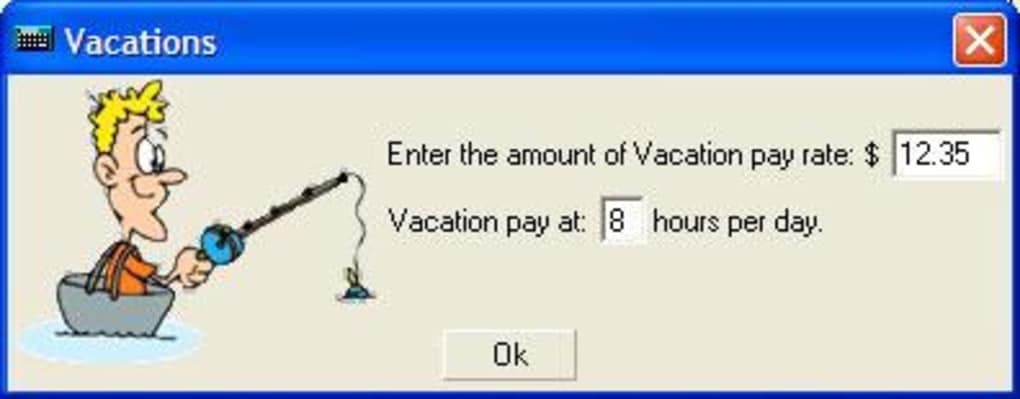

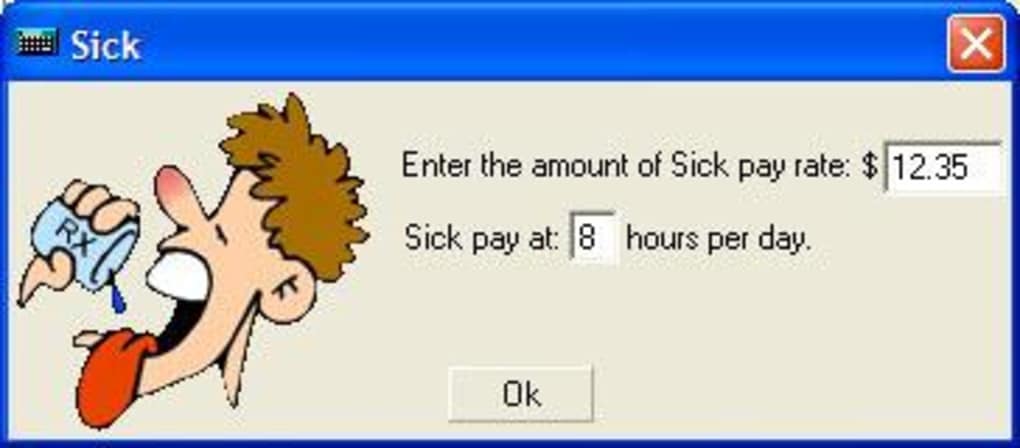

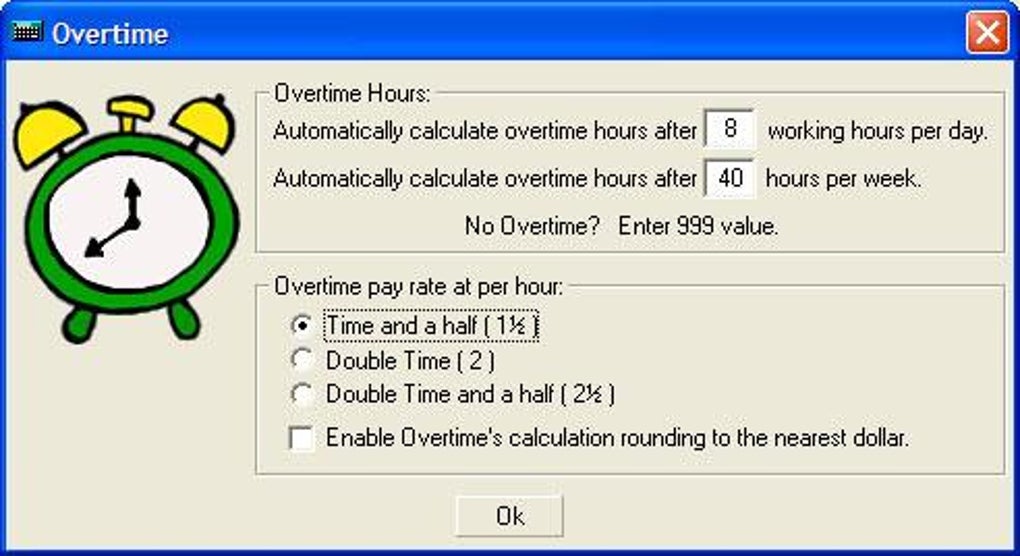

Calculating employee wages is complicated even before you even start considering unique pay situations.

. Payroll Calculator para PC en el emulador de Android le permitirá tener una experiencia móvil más emocionante en una computadora con Windows. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Determine your taxable income by deducting pre-tax contributions Withhold.

Heres a step-by-step guide to walk you through. Juguemos Payroll Calculator y. Its a simple four-step process.

One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees. By accurately inputting federal withholdings allowances and any relevant. It will confirm the deductions you include on your.

This free easy to use payroll calculator will calculate your take home pay. This is the amount that gets paid in your bank by your employer every month. For the same employee monthly PCB for salary alone will be RM 130 so the tax for bonus is RM 650 - RM 130 RM 520.

Attend our next free webinar on Thursday May 9th. Supports hourly salary income and multiple pay frequencies. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Your monthly net pay will be 2851. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Subtract any deductions and.

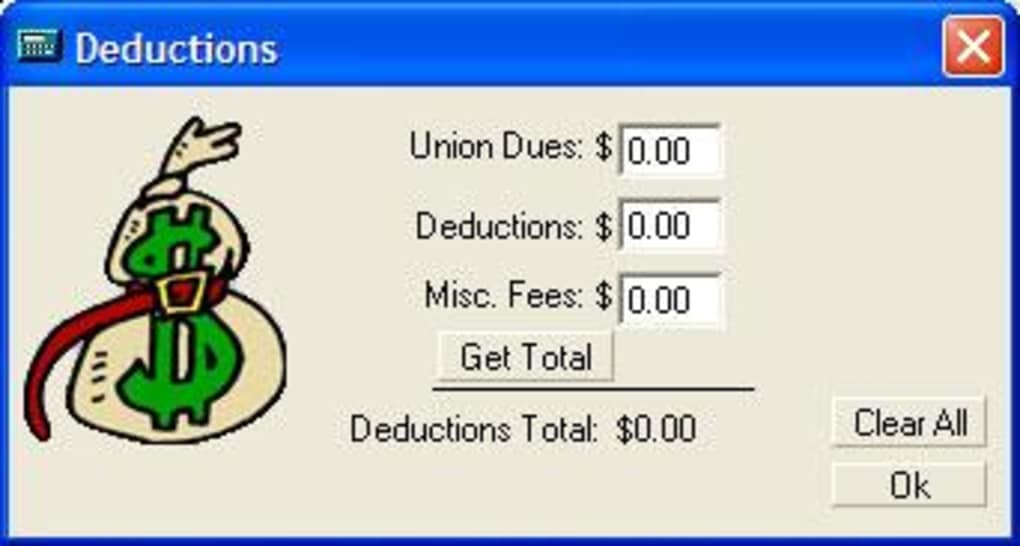

A paycheck calculator allows you to quickly and accurately calculate take-home pay. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Alternatively you may change the Calculate For option to Bonus Only. This number is the gross pay per pay period. Gross-Up Calculator This calculator determines the amount of gross wages before taxes and deductions are withheld given a specific take-home pay amount.

The salary calculator is a great tool when hiring employees. Your hourly rate Your hourly rate as advertised by employers on job. Important note on the salary paycheck calculator.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Plug in the amount of money youd like to take home. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

The calculator will show you the costs of hiring employees or raising wages and allow you to delve into other employer.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Download

How To Prepare Payroll In Excel This Wikihow Teaches You How To Calculate Payroll For Your Employees In Microsoft Excel Creating A Payro Payroll Excel Salary

Best Free Payroll Software For 2022

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Download

Payroll Independence Mo Sperry Associates Cpa Pc

Payroll Coffman And Company P C

Payroll Calculator Download

Payroll Calculator Free Employee Payroll Template For Excel

Get A 10 Key Calculator On Your Pc

Updated Salary Paycheck Calculator Us Mod App Download For Pc Mac Windows 11 10 8 7 Android 2022

Dod Educates Military Service Members Civilian Employees On Social Security Payroll Tax Deferral Joint Base San Antonio News

Sjcomeup Com Grss Salary Calculator For Shanghai

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel